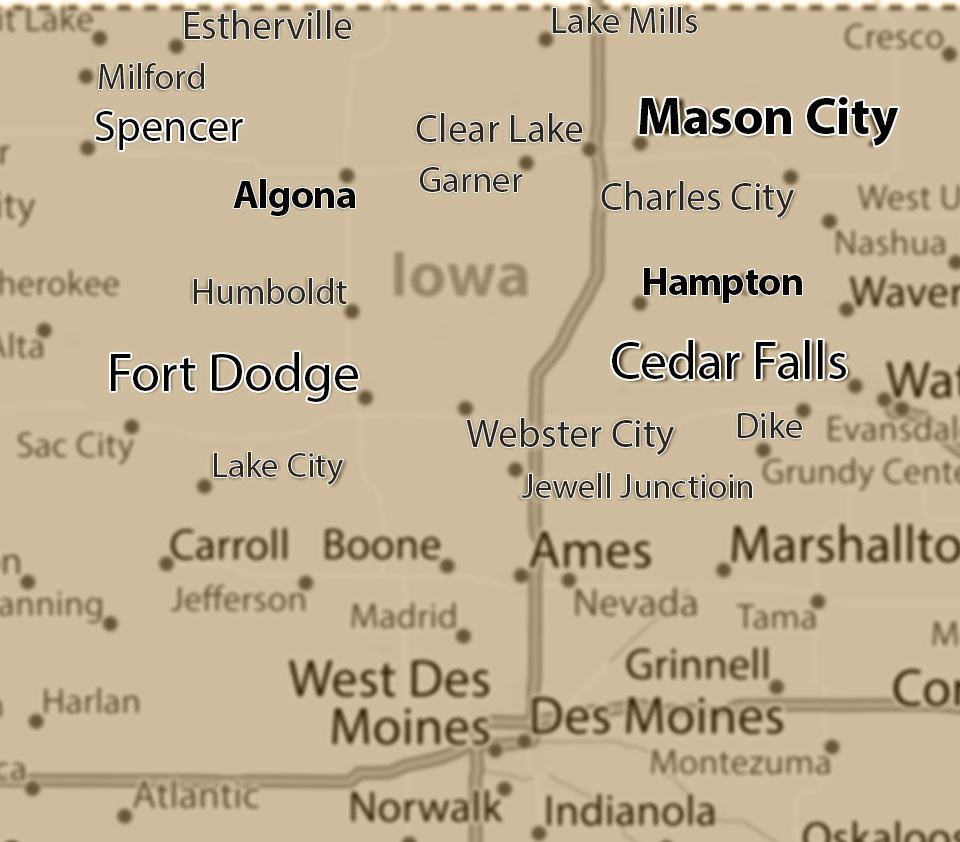

Mason City Estate Planning Lawyer

Mason City Estate Planning Attorney

Setting up an estate plan is a good way to ensure that your assets all go where you want them. This plan can determine which of your loved ones gets your assets, what charities benefit, and keep your loved ones from dealing with the lengthy and expensive probate process. An estate plan can also provide directions for your care at the end of your life and provide guardianship determinations for any minor children.

However, if a will is created, and the court doesn’t find it to be legal after your death, those plans are ineffective. Working with a skilled Mason City estate planning attorney can help you create a comprehensive estate plan that follows your wishes and is considered legitimate by the court.

Estate Planning with O’Mara Law Office, PLLC

Creating an estate plan in Mason City, IA is much easier with the help of a legal professional. Working with an attorney can also ensure that your estate plan remains updated as you deal with major life changes. There are several documents and entities that make up a comprehensive estate plan, and O’Mara Law Office, PLLC, can help you determine what is right for your needs based on your objectives.

Estate planning requires care, so our attorneys listen to your situation and wishes for an estate plan, then tailor our advice and counsel to fit. We can help you draft your estate plans, determine beneficiaries and trustees, allocate your assets, and maintain them throughout your life. You should feel confident about how your estate plan will be carried out after your death. Effective estate planning can help your family and loved ones avoid probate.

What Is Estate Planning?

Creating a comprehensive estate plan ensures that your assets are distributed to your chosen beneficiaries after your death. It can also provide further instructions to distribute other assets as you want. An estate plan can be contested after your death, so working with an attorney can prevent legal issues and ensure that your wishes remain intact. Effective estate planning limits inheritance and other taxes as much as possible, so your beneficiaries receive the most benefits from your estate.

An estate plan is made up of several documents, including:

- Will: This lists your wishes for your assets and property after your death, but it does not avoid probate.

- Trust: A trust places your assets in a revocable or irrevocable trust prior to your death. That way, the assets pass to the trustee after your death and do not enter probate.

- Durable Power of Attorney: This assigns a person the power to make legal decisions on your behalf if you are incapacitated and unable to make them yourself.

- Medical Power of Attorney: Through this, someone you trust can oversee your healthcare decisions if you are unable to make them. This includes advanced medical directives, which state where you want to receive healthcare and what medical care you do and do not want.

Your estate plan may also provide for other decisions, such as:

- Establishing guardianships and conservatorships for minor children or adults who are unable to care for themselves

- Business succession determination

- Long-term care decisions

- Sale of assets

An estate plan aims to limit the time and expenses your loved ones will spend in probate. Working with an attorney on your estate plan provides clear intent to make a will and makes your resulting wishes likely to be considered legally valid.

Probate Court

Without an estate plan or will, a person’s assets enter probate court when they die. If the person does not have a will and an executor to manage it, the court will appoint an executor. This executor may or may not be someone you trust. Debtors and creditors will be paid from the estate, and then assets are distributed according to Iowa inheritance law. This order is:

- Spouses and children

- Parents

- Siblings

- Grandparents

- Extended relatives

- Descendants of a deceased spouse

Probate can take years to complete, and your estate may be subject to significant taxes. There is a simplified process of probate for smaller estates in Iowa.

A legally binding will can name who inherits what from your estate, and the use of trusts and other methods can lower the effect taxes have on your estate. It also determines who the executor of a will or trustee of a trust is, so you know you can trust the person handling your estate. An estate plan gives you more control over what happens to your assets and ensures that your family is taken care of.

Do I Need a Mason City Estate Planning Attorney?

If your estate plan is found legally invalid after your death, or family members successfully contest the legitimacy of your will, your estate will enter probate anyway. The most effective way to ensure your will and estate plan are found legitimate in court is with legal counsel from a professional. The laws governing estates and taxes change often, which is why hiring an estate planning attorney in Mason City is useful.

Your attorney can hear your goals for your estate and counsel you on what estate planning documents align with your interests. If you are worried that your estate plan may be contested, your attorney can help you determine useful strategies. This can better protect your assets for your intended beneficiaries.

Understanding Trusts

Assets that go through probate are subject to creditor claims, the claims of your beneficiaries, and other people who you don’t want benefiting from your estate. You can instead place your assets in a trust and name yourself as the trustee. You then name a successor trustee, who becomes the trustee after your death. Because the assets in a trust are always under the legal care of the trust and a trustee, they are not required to go through probate court. Your trustee will still have to pay creditors from the estate, but more benefits will pass to your beneficiaries.

O’Mara Law Office, PLLC, Can Help You Plan Your Future

The attorneys at O’Mara Law Office, PLLC, can determine your needs and intent for your assets and wealth, then help you craft an estate plan that meets those needs. We can aid you with every step of the process as you plan for your family’s future. Contact O’Mara Law Office, PLLC, today to see how we can help.